Buy the Book on Amazon Now!

Buy the Book on Amazon Now!

Wall Street has bombarded us for decades with marketing propaganda. Glittery ads and seemingly sage advice steer investors toward mediocre investments. It’s time to take control of your money. The Wealth Conspiracy reveals how advice from the financial industry is designed to baffle you into poor investments with higher fees. With The Wealth Conspiracy as your guide:

- Dig through the avalanche of financial marketing

- Expose the historical poor ethics of big financial firms

- Identify how most annuities buyers have been deceived

- Shelter from the tax time bomb Wall Street purposely ignores

- Protect yourself from investment risks and volatility

- Survive and thrive through the next financial disaster

- Calculate the surprisingly minimal advantage of tax-deferral

- Differentiate between building wealth and retirement planning

- Discover how 529 college saving plan can increase college cost

What are a few of the Conspiracies?

Conspiracy #1

Conspiracy #1

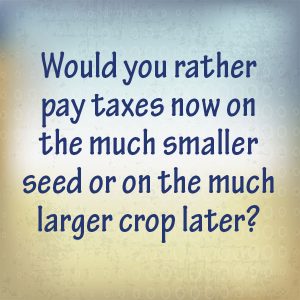

The over promotion of tax-deferred accounts provide minimum advantages. Financial firms deceptively focus on and promote the larger balances that these accounts appear to have. After all taxes are considered, these accounts provide only a minimal advantage in that the dividend and interest is allowed to compound without taxation until withdraw. These accounts may grow larger more quickly, but much of that growth belongs to various taxing authorities at future unknown tax rates. And you pay management fees on the government’s share of these accounts.

Conspiracy #2

The Intentional misrepresentation regarding future tax rates deceptively persuades investors to focus on tax deferred accounts that are more profitable for the big financial firms. Taxes are not likely to be lower when you retire but instead almost certain to be much higher.

Conspiracy #3

The over promotion of retirement planning ignores the higher need for liquidity and wealth building. Retirement is not and should not be the primary investment goal. Flexibility and liquidity should be of equally important. High management fees for longer periods can be collected if money remains in retirement targeted accounts. And so firms push the retirement planning agenda for their own benefit.

Conspiracy #4

Fee-based accounts are misrepresented as somehow better than commission accounts when in fact an investor may pay much more in fees that they would have in a commissions account. To be clear, I am not saying that fees are bad. At times fees are absolutely the best method to pay for investment advice. Fees or commission may be appropriate depending on the situation.

Conspiracy #5

Conspiracy #5

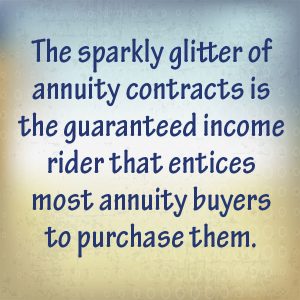

Shamefully designed and sold annuities trick investors to believe they are getting a significant interest rate of return for a lifetime income guarantee, when in many cases they are only getting a slow return of their own investments. Many annuity investors are misled into falsely believing that a fixed rate withdrawal is an interest rate they are receiving. In addition, deceptively named income or withdrawal account growth is designed to trick the investor into believing a guaranteed growth is occurring. In reality, these accounts cannot be withdrawn, are not real money, and are just accounting entry indications that an annuitant is closer to death, and so the insurance company can afford to make higher annual withdrawal from their account. However, if properly understood and focused on the cash value growth, an annuity can be a good investment.

Conspiracy #6

Financial firms ignore other investments that provide better returns and tax advantages than the typically recommended stocks, bonds, ETFs and mutual fund portfolios. This is because of reduced access due to pay-to-play issues and the lower fees and commission other investments may provide the firms.

Conspiracy #7

The disingenuous promotion of 529 college plans may actually increase the cost of college while providing profits to the financial firms. This is done in order to increase financial firms’ profitability at the expense of their clients.

Watch The Webinar Below