Where is the Conspiracy?

To understand the roots of the wealth conspiracy, we must first understand that the financial firms are not charitable organizations. They do not exist to benefit society at large. They exist to make a profit. They are essentially sales organizations with financial advisors as salespersons. Their concern for you is not always pure, nor does it come from positive motives.

Yes, advisors and their firms understand that they will lose you as a client if you realize they are not properly considering your best interest. This causes a game to be played where the firms do all they can to maximize their firm’s profits while satisfying their clients’ perceived needs. Unfortunately, satisfying their clients’ perceptions can be quite different from optimizing their clients’ portfolio performance or protecting them from losses.

The financial firms provide persuasive information to their advisors regarding what is best for the client, hoping the advisors will then parrot this information to their clients and prospects. These firms are too smart to make false statements. Instead, they cherry-pick true statements and facts, leading their clients to false conclusions without the firm needing to state the desired erroneous conclusion. The focus is on the company’s bottom line, and not optimizing the investor’s results.

The financial firms provide persuasive information to their advisors regarding what is best for the client, hoping the advisors will then parrot this information to their clients and prospects. These firms are too smart to make false statements. Instead, they cherry-pick true statements and facts, leading their clients to false conclusions without the firm needing to state the desired erroneous conclusion. The focus is on the company’s bottom line, and not optimizing the investor’s results.

They do this for two reasons. First, it is a more effective selling tool to let the clients come to their own conclusions. Second, not communicating the false conclusion provides legal protection from stating a falsehood.

You may ask, how could citing a fact lead to a falsehood? It’s simple. A half-truth—something short of all the information—can lead to a completely wrong conclusion. Presenting convincing absolutely true arguments, statements and facts without the counter balancing arguments, statements and facts, is stating a lie with truths. They never need to lie if you believe what they want you to believe. This is the essence of the conspiracy.

And the conspiracy is multi-generational. Today’s co-conspirators likely have no clue that they are part of it. They just repeat what they truly believe. The misrepresentations and falsehoods have become part of their core belief system—beliefs that are ingrained in their understanding of how the world works. And through their advice, marketing and advertising, you probably believe these falsehoods too. The point of this book is to point out the beliefs you likely have about investing and finance that are causing you harm.

It is important to note that your advisor is probably not intentionally misrepresenting the facts. Advisors truly believe their advice is best for you. After all, they are only regurgitating ideas that are now considered common and accepted as best business practices. But because wisdom is common and accepted does not mean it is correct. It was once common to believe the earth is flat.

This book will also point to evidence that the firms (if not the advisors) are aware that they are not telling the whole truth. This is why they stay away from stating conclusions and instead, rely on the advisor or client to come to the desired conclusion.

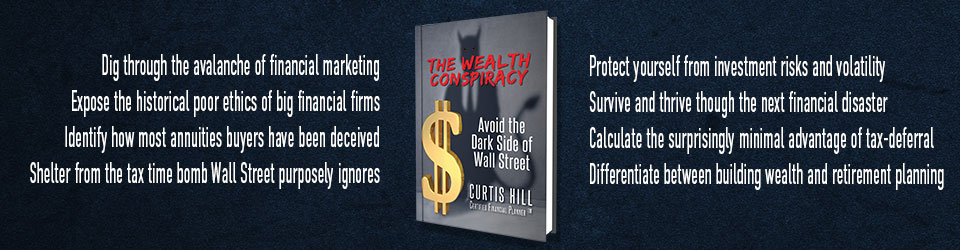

I don’t expect to gain popularity in the financial industry for revealing the truth. I will be trying to show both sides—the good and the bad of an investment decision. I will also provide options to avoid the pitfalls caused by outdated thinking and real solutions to grow your money intelligently and efficiently. Uncover the wealth conspiracy and unravel the tangled web of misinformation that has held generations of Americans back from reaching their financial goals.

~Curtis Hill